Have you tried Claude in Excel?

Claude now works inside Excel. It reads your data and edits your spreadsheet directly, without exporting, switching interfaces, or losing context.

For years, Excel expertise was a moat. The people who could build what others couldn't had leverage. I stress-tested Claude's add-in on work that normally takes hours and requires domain knowledge.

Here's what happened.

TOOLS

1. Caretta:

Real-time AI assistant that helps sales reps answer technical questions during live calls. Learns from company documents, website, documentation, and top-performing reps. Surfaces relevant answers automatically when prospects ask questions.

2. EigenPal:

Automates document data extraction from invoices, contracts, KYC documents, and forms. Handles messy scans and handwritten text. Includes workflow testing, accuracy monitoring, and on-premise deployment options for enterprise security requirements.

3. Maywood:

AI execution layer for investment banks. Automates deal decks, diligence, and research so deal teams focus on judgment instead of PowerPoint. Updates propagate across all materials automatically.

The Setup

What you need:

Claude Pro subscription ($20/month) + Excel

Download add-in from Anthropic (runs on Claude Opus 4.6)

Enable "Accept All Edits" mode (required for Claude to read your data)

One quirk: authorization opens in your default browser. If it opens in Edge and you use Chrome, copy the link manually.

The Walkthrough

The task: build a variance dashboard, reforecast the year, and extend a leadership model. Something you probably do every month.

What this normally costs you:

Time: A full day.

What I gave Claude: Test1_Main_Walkthrough.xlsx

Excel file with

Budgettab (full year P&L by month)January,February,Marchtabs (actuals with memo fields containing transaction details)Consolidated ViewandCore Businesstabs (5-year projections)

Step 1: Memo Scanning, Automated

Prompt:

"Build an actuals versus budget dashboard for Q1. Make it monthly and for the entire quarter. Add narrative notes where you can infer what happened."

Claude read all sheets and built variance tables (budget, actual, variance $, variance %) for each month and the full quarter.

It scanned the memo fields and pulled company names. Acme Corp early close, TechStart referral win, Enterprise Co deal in March drove Product Sales. It found a Q1 overachievement bonus buried in the January transaction notes. I'd forgotten it was there.

Then the formatting. Conditional coloring on variances, green for favorable, red for unfavorable. It reversed the logic for costs: an 8% increase in COGS showed red because higher costs are bad. Accounting logic I never specified.

It froze the header rows and columns for easy scrolling, added section dividers between Revenue, COGS, and Operating Expenses, and indented sub-items under their parent categories. Currency and percentage formatting throughout.

Didn't overwrite a single existing cell.

Time: 15 minutes of Claude processing, no intervention needed. Still faster than the 3-4 hours I'd spend building pivot tables and writing SUMIF formulas.

Step 2: Formulas Work

I changed a number in my January actuals. Went back to the dashboard. The numbers updated automatically.

Claude had used formulas: =January!B4+January!B5+January!B6

The dashboard was fully dynamic. Change a source number, everything updates.

Step 3: Session Memory Actually Works

Prompt:

"Reforecast the rest of the year based on Q1 performance and original budget data. Do that in a new tab with the same structure as the budget tab. Then give me a year-to-year comparison of the new budget versus the old budget with a short explanation of why we changed it."

Claude created two sheets: Reforecast P&L with the full-year projection and Budget vs Reforecast with a comparison table.

It also added a "Why We Changed It" column with full explanations for every line item. I never asked for it.

The rationale referenced specifics from Step 1 that I never mentioned in this prompt:

"Product Sales: early enterprise deals (Acme Corp, Enterprise Co) and new customer wins (TechStart)"

"Salaries: Added $5K quarterly performance bonuses based on Q1 overachievement pattern"

"Direct Materials: scaling more efficiently than revenue (good sign)"

No re-explaining context. No follow-up prompt needed. It carried everything forward from Step 1.

The sidebar even generated an executive summary: revenue growth vs. cost growth, margin improvements, operating leverage. CFO-level narrative, without a prompt for it.

Time: 28 minutes.

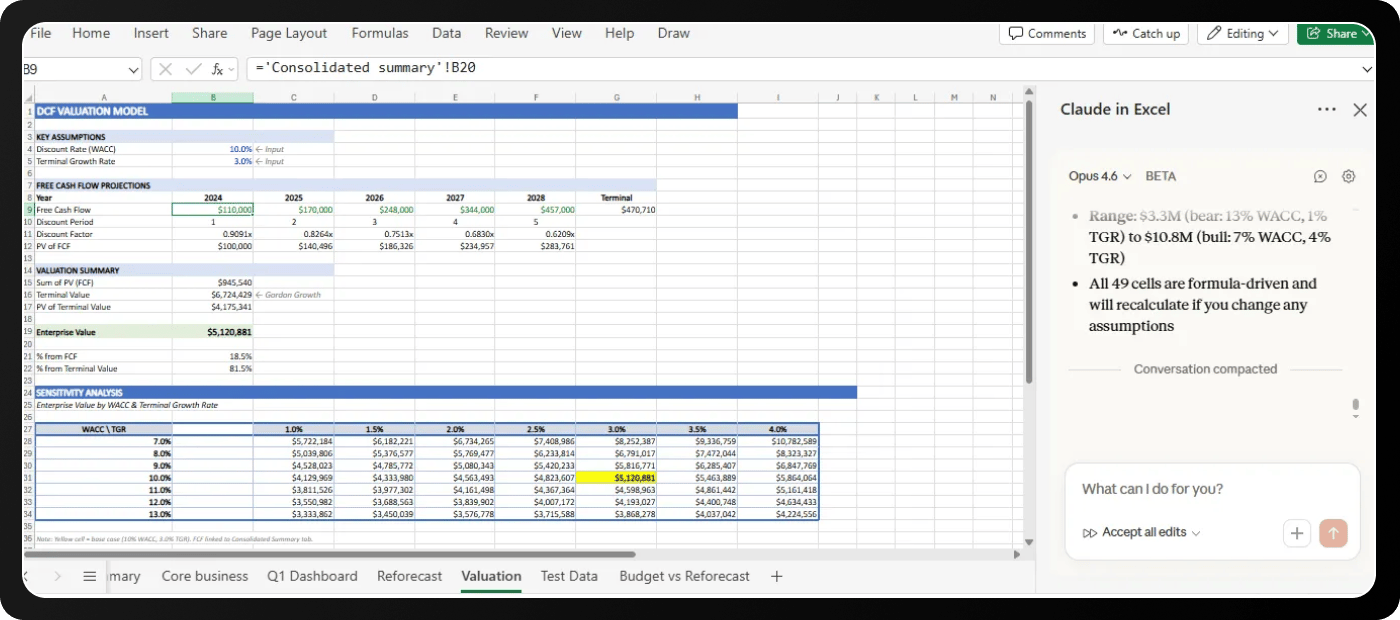

Step 4: DCF Built But Hardcoded

Prompt:

"Create a valuation sheet using the consolidated view data. Add a sensitivity table for discount rate and terminal growth."

Claude read both Consolidated View and the Core Business sheets. Inferred the relationship (consolidated pulls from core business) without me explaining it. Built a DCF valuation with terminal value calculation using the Gordon Growth model.

I clicked on the Free Cash Flow cell. Formula bar showed ='Consolidated summary'!B20. An actual formula linking to the source data.

The sidebar confirmed: "All 49 cells are formula-driven and will recalculate if you change any assumptions."

The sensitivity table covered a 7×7 grid of WACC and terminal growth rate combinations, with the base case highlighted in yellow. The sidebar summarized the full valuation range from a bear to a bull scenario.

A source note at the bottom: "FCF linked to Consolidated Summary tab."

Change a scenario in Core Business, and the valuation updates automatically.

Time: 12 minutes.

What Actually Changes

I used to do five things: build, format, wire formulas, debug, and review. Now I do one. Claude handles the first four.

The scanning, the SUMIFs, the table-building: hours of mechanical work compressed into minutes. But judgment stays with me. I still need to know what a balance sheet is. Claude handles the mechanics; I handle the strategy.

The Bigger Signal

Claude is building directly into the software. It skips the export step, the API wrapper, and the middleman. Excel is just the first one.

Excel skill was treated as a baseline requirement. Now the advantage moves from who knows Excel best to who can direct Claude effectively and audit the output.

Excel knowledge doesn't disappear. It helps you ask sharper questions and push Claude further than someone starting from zero could.

If Claude keeps improving at this pace, specialized software skills as a differentiator will erode fast. Any tool where expertise meant knowing how to build complex things yourself is exposed to the same shift. Right now, most people haven't touched this. That gap won't last.

Would you trust it to build your board deck? Reply and tell me.

Until next time,

Vaibhav 🤝🏻

If you read till here, you might find this interesting

#AD1

AI is all the rage, but are you using it to your advantage?

Successful AI transformation starts with deeply understanding your organization’s most critical use cases. We recommend this practical guide from You.com that walks through a proven framework to identify, prioritize, and document high-value AI opportunities. Learn more with this AI Use Case Discovery Guide.

#AD2

The best marketing ideas come from marketers who live it.

That’s what this newsletter delivers.

The Marketing Millennials is a look inside what’s working right now for other marketers. No theory. No fluff. Just real insights and ideas you can actually use—from marketers who’ve been there, done that, and are sharing the playbook.

Every newsletter is written by Daniel Murray, a marketer obsessed with what goes into great marketing. Expect fresh takes, hot topics, and the kind of stuff you’ll want to steal for your next campaign.

Because marketing shouldn’t feel like guesswork. And you shouldn’t have to dig for the good stuff.